Oil’s rising price poised to boost energy sector

Crude oil prices surged over the summer as OPEC curtailed production, followed by the outbreak in early October of the Israel-Hamas war, which sparked fears of greater military conflict throughout the region. While higher oil prices may prove challenging for overall equity performance, energy stocks appear poised to benefit if commodity prices resume their ascent.

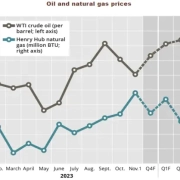

Oil’s surge and drop: Oil prices had risen following the eruption of violence in the Middle East, but have since fallen. West Texas Intermediate closed at $80.44 on Nov. 1 vs. $82.79 on Oct. 6, but will increase by more than 10% next year, according to U.S. Energy Information Administration forecasts. However, the EIA notes that its forecasts don’t take into account impacts from recent geopolitical events. Natural gas prices were recently $3.44 per million BTU compared to $3.34 on Oct. 6.

Click here to read the full article

Source: Pensions&Investments

—

If you have any questions or thoughts about the topic, feel free to contact us here or leave a comment below.